Payment experts say the Apple card probably won’t draw in savvier consumers, which means Apple’s chief rivals won’t rush in to compete with this card. The hot new thing in payments procedure is… plastic?

On Monday Apple 25th March 2019 introduced the Apple card, a credit card that exists as both a virtual card in Apple’s Wallet app and a physical card. Apple’s card comes out after the few years when digital money companies PayPal, Square, and PayPal-owned Venmo all introduced their own physical credit, debit and prepaid cards.

Surely all this excitement for good and reliable cards means Google and Samsung won’t be too far behind, trotting out their own Google Pay Card and Samsung Pay Card. Wipe away the Apple mystique, and you’re left with a credit card that’s got underwhelming features and is unlikely to draw in savvier consumers, several payment experts say. Which means its chief payment rivals probably won’t rush to come up with competing cards for Apple card.

Ted Rossman said that “a card comparison site owned by Bankrate” so I doubt that Google and Samsung are losing a lot of sleep over this card. Apple Pay is stagnated for years and now Apple Card arrives at a time for adoption of mobile payment services, with most US customers instead opting for simpler cash or cards. Many customers pay at checkout with what they know will be accepted and never ask for the mobile option because of its lack of ubiquity is a major hurdle for mobile payments.

The physical Apple Card helps to solve this problem since cards are accepted at every store. It is an acknowledgment from Apple that mobile payments haven’t caught on just yet. According to the study at PYMNTS.com. that less than a third of iPhone owners used Apple Pay at least once.

The Apple Card also explain how the tech industry needs to work in the present while trying to usher in the future. Consumer habits are difficult to change so that the tech companies like Amazon building stores is further evidence but there’s still money to be made using old-fashioned methods.

No Google or Samsung

Payments experts mostly saw challenges for Google and Samsung while considering the potential for a card of two companies. The credit card industry in the US is heavily regulated and extremely competitive, preventing tech players from diving in. Plus, neither company has the same fanboy-fueled brand power as Apple or a bunch of its own retail stores, making things even harder for them to create waves in payments.

Google did offer a physical debit card for Google Wallet, a predecessor of Google Pay, but it shut down that program in 2016. Also, Samsung runs a credit-card company called Samsung Card in South Korea.

It is necessary for both of them that not to jump in unless they saw that this Apple move was successful. According to Matt Schulz, who is an analyst at CompareCards said, a Lending Tree-owned card comparison site.

According to Rivka Gewirtz Little who is a payments analyst at research firm IDC said, people wouldn’t be surprised to see Google and Samsung show off their own cards because big tech companies are always looking for more ways to push into the financial world and create more services to get people to spend money.

“I don’t see any reason why they wouldn’t do it,” Rivka Gewirtz said. “I don’t think there’s any mistake in doing it.”Apple declined to comment for this story but Google and Samsung didn’t respond to a request for comment to her.

Apple Card: Meh

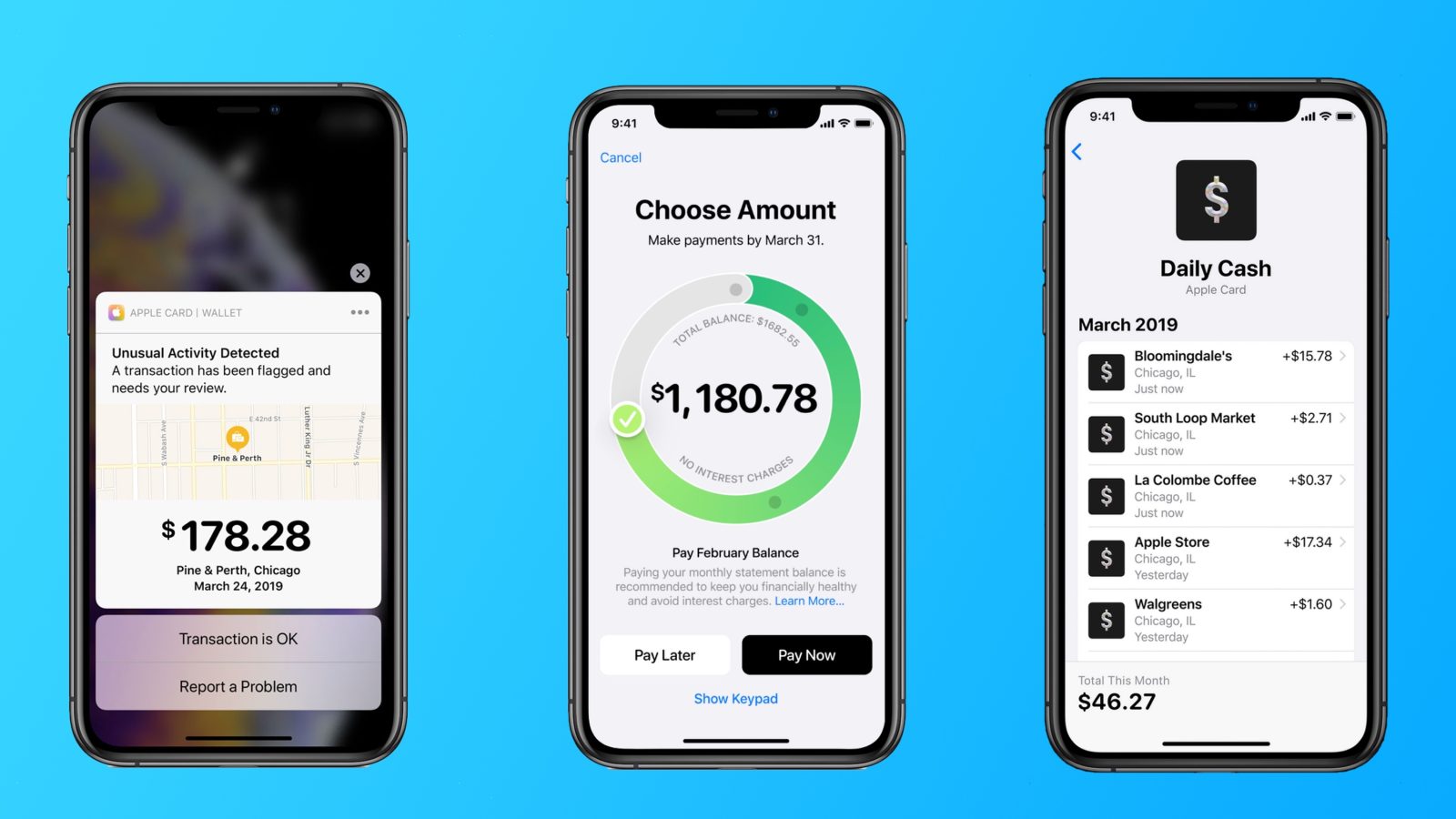

The Apple card which is going to launch will be available in the US this summer and there are no annual fees, late fees, over-limit fees, and international fees but if you pay late then it will raise up your interest rate. This card also offers you daily cash reward, when you buy directly from Apple then 3% back, 2% back when paying through Apple Pay and 1 % back when paying using the card.

The company also add up Apple Card’s security features, while making each digital payment you have to use Touch ID or Face ID and a one-time security code. Apple also not going to collect customer data like “where they shop, what they buy or how much they spend”. Apple teamed up with MasterCard and Goldman Sachs to offer its Apple card.

MasterCard spokeswoman Chaiti Sen said her company expects to create more digital-first cards like Apple Card eventually but confirmed that MasterCard is working only with Apple on such a concept right now.

Some of the payment analysts said that “Apple Card’s features were far from game-changing” and other said that “existing cards offer similar, no better benefits, lack of a sign-up bonus,” they also said that these type of cards are usually seen as a missed opportunity.

Also Read: Apple’s iPad mini 4 and iPad Pro 10.5 are on sale again, this time at up to $430 discounts

“A lot of the Apple Card stuff said it just feels like a series of half measures,” Rossman said. “I’m surprised they didn’t go all in on something.”

Apple clearly wants to use the card to get more people to use Apple Pay and keep them loyal to its products and services. These experts didn’t think about is it offers enough to do that? Considering that comments from peoples it feels like that the pressure for Google and Samsung to move on their own cards isn’t as great as if Apple had introduced a card that could shake up the card industry.

“It’s definitely not enough to make people jump over,” Little said of Android users. “It might be enough to get iPhone users to stick around a bit longer.”